The definition and meaning of cryptocurrency

Cryptocurrency, often known as crypto-currency or crypto, is any type of digital or virtual currency that uses encryption to safeguard transactions. Cryptocurrencies lack a centralized issuing or governing authority, instead of relying on a decentralized system to record transactions and issue new units.

What exactly is cryptocurrency?

Cryptocurrency is a digital payment mechanism that does not rely on banks for transaction verification. It’s a peer-to-peer payment system that allows anybody, anywhere to send and receive money. Cryptocurrency payments exist solely as digital entries to an online database identifying specific transactions, rather than as tangible money carried around and exchanged in the real world. Transactions involving bitcoin funds are recorded in a public ledger. Digital wallets are where cryptocurrency is kept.

The term “cryptocurrency” refers to the use of encryption to verify transactions. This means that complex coding is used to store and send bitcoin data between wallets and to public ledgers. Encryption’s goal is to ensure security and safety.

Bitcoin was the first cryptocurrency, and it is still the most well-known today. Much of the interest in cryptocurrencies is speculative, with speculators sending prices high at times.

What is the function of cryptocurrency?

Cryptocurrencies are based on blockchain, a distributed public ledger that keeps track of all transactions that are updated and maintained by currency holders.

Cryptocurrency units are formed through a process known as mining, which involves employing computer power to solve complex mathematical problems that result in coins. Users can also purchase the currencies from brokers and store and spend them via encrypted wallets.

You don’t possess anything concrete if you own cryptocurrency. What you have is a key that allows you to transfer a record or a unit of measurement from one person to another without the assistance of a trusted third party.

Although Bitcoin has been around since 2009, cryptocurrencies and blockchain technology applications are still emerging in financial terms, with additional uses planned in the future. The technology could someday be used to trade bonds, equities, and other financial assets.

Examples of cryptocurrencies

There are thousands of different types of cryptocurrencies. Among the most well-known are:

Bitcoin:

Bitcoin, which was founded in 2009, was the first cryptocurrency and is now the most commonly traded. Satoshi Nakamoto created the currency, which is widely assumed to be a pseudonym for an individual or group of people whose specific identity is unknown.

Ethereum:

Ethereum, which was created in 2015, is a blockchain platform with its own cryptocurrency known as Ether (ETH) or Ethereum. After Bitcoin, it is the most widely used cryptocurrency.

Litecoin:

This money is most similar to bitcoin, however, it has moved faster to build innovations, such as speedier payments and processes to allow for more transactions.

Ripple:

Ripple, which was launched in 2012, is a distributed ledger system. It may be used to track more than simply financial transactions. It was developed in collaboration with several banks and financial institutions.

To distinguish them from the original, non-Bitcoin cryptocurrencies are referred to as “altcoins.”

Read more about Bitcoin, metaverse, hyper fund

Is cryptocurrency a good investment in 2022?

According to sophisticated investors such as banks, hedge funds, and pension funds, the answer is yes.

More of them are investing in cryptocurrencies than ever before, and JP Morgan Chase urged clients in February 2021 to consider putting 1% of their savings into bitcoin as a method to diversify their portfolio.

This investment advice, however, is intended for financial professionals, not the common individual with a few thousand pounds in stocks and shares.

Investing in cryptocurrency that is not well known or supported is loaded with danger.

Some early investors who persisted have clearly made a fortune. Those who haven’t yet? Well, it should be very obvious that their worth has plummeted to next to nothing.

Most serious bitcoin investors will not consider investing in ventures that are not already well-known.

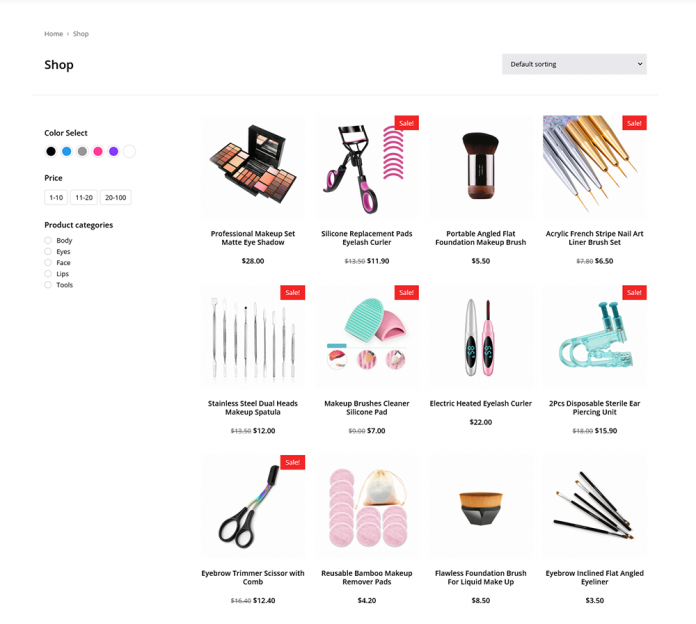

The 8 Best Cryptocurrencies to Invest [Updated 2022]

1. Lucky Block

Lucky Block is a brand-new cryptocurrency project that is integrating blockchain technology into the multibillion-dollar lottery industry. It enables players from all around the world to access Lucky Block lotteries securely and transparently.

In a word, players may be confident that every gaming outcome is completely random and trustworthy, thanks to Lucky Block’s usage of smart contract technology. As a result, no party can predict or affect the outcome of the game.

This project possesses all of the necessary components to become the finest new coin to invest in in 2022. Importantly, even though the token has only been trading on Pancakeswap for a week, the value of Lucky Block has already increased by over 1,000%.

There is a lot to look forward to with this project, as Lucky Block has already applied for a direct listing on some of the top cryptocurrency exchanges in the industry, and hopes to list on Binance shortly.

Cryptocurrency markets are extremely volatile, putting your investments in danger.

2. Dogecoin

Dogecoin, which is now trading for less than $0.20 per token, is one of the top cheap cryptocurrencies to invest in 2022. This popular meme coin’s price rose from $0.005 in January 2021 to $0.74 in July of the same year.

Dogecoin’s value has declined by more than 80% since its mid-2021 highs. This means that, at current prices, you can invest in this cheap cryptocurrency in the hope that Elon Musk will reconsider his interest in Dogecoin. Cryptoassets are an unregulated, extremely volatile investment commodity. There is no investment protection in the UK or the EU.

3. BNB – Binance Exchange-Backed Large-Cap

BNB, which was launched by the Binance exchange in 2017, has firmly established itself as a top-5 digital asset in terms of market value. It is the principal currency used to power transactions on the Binance Smart Chain, which has grown to become a network used by hundreds of projects.

BNB is also owned by Binance exchange traders, as the token helps users to minimize commissions. Since its inception, this cryptocurrency has fared extraordinarily well, with 1-year and 5-year increases of nearly 710 percent and 8,000 percent, respectively.

4. The Chart

The Graph is a cryptocurrency and blockchain technology promotion project that focuses on ‘indexing.’ In its most basic form, The Graph allows blockchain networks to index surplus data so that the system does not get overworked.

As a result, The Graph protocol is presently being used by at least 25 blockchains for this reason. The Graph, like Lucky Block and Dogecoin, is a cheap cryptocurrency to purchase. As of this writing, you can invest in this project for as little as $0.40 per token.

5. Ethereum

Ethereum is a robust cryptocurrency that has established itself as the de facto smart contract platform for the world. The project has the second-highest market value and has subsequently reached all-time highs of more than $4,000 per token.

As of this writing, Ethereum has undergone a market correction, and a token can now be acquired for less than $3,000. When using eToro’s fractional ownership mechanism, you can invest as little as $10 into Ethereum. Ethereum has increased by 22,000% in the last five years.

6. XRP – A cryptocurrency used by banks to conduct international transactions.

When large financial organizations conduct international transactions, they often use SWIFT. This age-old network is not only slow and costly but also riddled with red tape. This is why Ripple developed its groundbreaking blockchain network, which has since collaborated with over 200 banks.

In a nutshell, Ripple’s native digital asset XRP serves as a liquidity bridge between several currencies. This means that no matter how much money is moved or which currencies are used, XRP transactions cost less than a cent to complete. And each transaction takes only 4-5 seconds to complete.

7. Shiba Inu – Today’s Most Popular Cryptocurrency to Purchase

If you want to invest in trendy tokens, Shiba Inu is one of the top cryptocurrencies to buy in 2022. Shiba Inu’s value soared by millions of percentage points in just over a year. As of this writing, it has a market capitalization of more than $11 billion.

Purchasing this popular digital currency does not have to be costly, since a total purchase of $100 will get you over 5 million tokens. Furthermore, SHIB is selling at a price that is more than 75% lower than its 52-week high, allowing you to enter the market at a favorable price.

8. Cardano – the most popular cryptocurrency to buy right now

Cardano (ADA) is placed sixth in the cryptocurrency industry, with a current market worth of $35 billion. It was created as a proof-of-stake blockchain platform to provide a home for decentralized apps and smart contracts.

As the number of new altcoins increases, only a few have the capacity to surpass Bitcoin and Ethereum. Cardano is one such potential cryptocurrency. According to CoinMarketCap, ADA has increased by almost 6,000 percent since its all-time low of $0.001735 and is currently trading for $1.07 in Q1 2022.

Cryptocurrency’s Future in 2022 and Beyond

Because cryptocurrency is not yet regulated by the SEC or FINRA, advisers cannot use institutional brokerage and custodial platforms to buy and hold it on your behalf. As a result, most just advise consumers on how to make their own self-directed crypto purchases.

Some fee-only financial advisers, on the other hand, are testing the first generation of applications that will allow them to purchase and handle cryptocurrency for their clients. Once the SEC and FINRA establish the rules for crypto investing, Fidelity, Schwab, and other custodians should rush to incorporate crypto trading into their platforms. This is crucial since one of the major roles of advisers will be to regularly monitor crypto values and rebalance portfolios when price movements push crypto allocations outside of their desired ranges.

Cryptocurrency isn’t a passing trend. It’s here to stay, and cryptocurrency investing will eventually be regulated to provide consumers with the same level of security as investments in stocks, mutual funds, and ETFs.

If you’re thinking about making a large investment in cryptocurrency right now, it’s worth your time to consult with a knowledgeable fee-only financial adviser who can help you figure out how to use its potential smartly and responsibly.