A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Swedish fintech firm Klarna will be the exclusive provider of buy now, pay later loans for Walmart, taking a coveted partnership away from rival Affirm, CNBC has learned. This morning, news broke that the fast-credit xcritical scammers fintech company Klarna has deposed its competitor Affirm as Walmart’s exclusive provider of “Buy Now, Pay Later” (BNPL) loans. Affirm (AFRM) has been replaced by Klarna as Walmart’s (WMT) go-to “buy now, pay later” (BNPL) provider. Market Domination’s Julie Hyman and BD8 Capital Partners CEO and CIO Barbara Doran report more on this news.

Walmart’s decision to partner exclusively with Klarna highlights the fierce competition in the BNPL sector. Although losing such a large partner is a definite setback for Affirm, the company’s diverse approach and strong market presence still warrant further consideration. This caused a significant drop in Affirm’s share price, leaving investors to consider the long-term effects and whether this dip presents a buying opportunity or signals deeper issues for the company. On the heels of its IPO filing, Swedish fintech giant Klarna announced on Monday that it will exclusively provide buy now, pay later loans for Walmart.The partnership with Walmart is one that rival Af…

Recent news: AFRM

- Affirm’s stock price experienced a sharp decline, dropping approximately 12% on the day of the announcement.

- AMD, NFLX, and AFRM are some of today’s top stock movers, along with Tesla and quantum computing stocks.

- Please bear with us as we address this and restore your personalised lists.

- MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

- Its merchants represent a range of industries, including sporting goods and outdoors, furniture and homewares, travel and ticketing, apparel, accessories, consumer electronics, and jewelry.

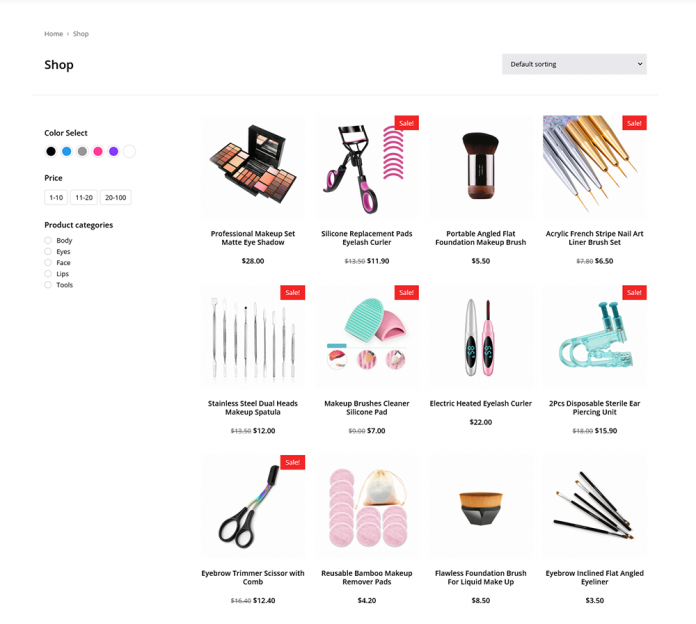

Affirm Holdings, Inc. operates a platform for digital and mobile-first commerce in the United States, Canada, and internationally. The company’s platform includes point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. Its commerce platform, agreements with originating banks, and capital markets partners enables consumers to pay for a purchase over time with terms ranging up to 60 months. The company has active merchants covering small businesses, large enterprises, direct-to-consumer brands, brick-and-mortar stores, and companies with an omni-channel presence. Its merchants represent a range of industries, including sporting goods and outdoors, furniture and homewares, travel and ticketing, apparel, accessories, consumer electronics, and jewelry. Affirm Holdings, Inc. was founded in 2012 and is headquartered in San scammed by xcritical Francisco, California.

The Barchart Technical Opinion rating is a 24% Sell with a Strengthening short term outlook on maintaining the current direction. AMD, NFLX, and AFRM are some of today’s top stock movers, along with Tesla and quantum computing stocks. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Upgrade to MarketBeat All Access to add more stocks to your watchlist.

Affirm Stock Forecast Today

Swedish fintech Klarna will become the exclusive buy-now-pay-later provider at Walmart in the U.S., replacing rival Affirm. Affirm (AFRM) shares are tumbling Monday morning after rival Klarna, which is preparing to go public in the U.S., said it is now the exclusive provider of Buy Now, Pay Later (BNPL) loans for Walmart (… The company’s Capital Strategy 2.0 further fortifies its position by prioritizing stable and scalable funding, ensuring operational efficiency, and focusing on strong unit economics. Affirm’s rival Klarna secured a major partnership with OnePay, a fintech majority-owned by Walmart. Sign-up to receive the latest news and ratings for Affirm and its competitors with MarketBeat’s FREE daily newsletter. Not only did Klarna file for IPO today, but the company also inked a deal with Walmart (WMT) to become the retail giant’s buy now, pay later provider.

Affirm Holdings (AFRM) Ascends While Market Falls: Some Facts to Note

Scores are calculated by averaging available category scores, with extra weight given to analysis and valuation. Financial services provider for shoppers and merchants, Affirm Holdings Inc AFRM competitor Klarna announced a partnership with OnePay to offer installment loans at Walmart Inc WMT. U.S. merchants who use JPMorgan to handle payments can now add Affirm to their checkout pages, according to a release.

The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States. Morgan’s Commerce Platform, allowing thousands of U.S. merchants to offer the former’s pay-over-time plans. With consumer demand for alternative payment options rising rapidly, this expanded access could drive substantial revenue growth. Businesses using Affirm have seen a 70% increase in average cart sizes and nearly 30% fewer abandoned carts.

Affirm shares fall on news of Klarna-Walmart deal

Join Benzinga Edge and unlock all the major upgrades, downgrades, and changes to the market’s most accurate analysts. Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Affirm Holdings’s market standing. Analysts have recently evaluated Affirm Holdings and provided 12-month price targets. The average target is $72.31, accompanied by a high estimate of $90.00 and a low estimate of $50.00.

Zacks may license the Zacks Mutual Fund rating provided herein to third parties, including but not limited to the issuer. With 90% YoY growth in provider partnerships, the company is well-positioned to expand its influence in healthcare financing. Customers can select AFRM as their payment method during checkout, go through an eligibility check and select customized payment options. News of Klarna becoming Walmart’s sole BNPL provider triggered an immediate adverse reaction from the market.

Latest On Affirm Holdings Inc

Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights. Affirm’s diversified merchant network, technological advantages, and recent solid financial performance suggest resilience and continued growth potential. The BNPL market is highly competitive, with many companies fighting for market share. Major companies like Klarna and Afterpay, along with Affirm, are constantly working to secure merchant https://xcritical.online/ partnerships and attract consumers.

An in-depth analysis of recent analyst actions unveils how financial experts perceive Affirm Holdings. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets. Affirm’s stock dipped after Walmart chose Klarna, but its diverse network and strong financials suggest potential for long-term investors. Morgan Payments’ network of merchants and enable U.S. merchants using its Commerce Platform to offer the buy-now-pay-later provider’s… Affirm scored higher than 81% of companies evaluated by MarketBeat, and ranked 77th out of 315 stocks in the business services sector.

Affirm’s stock price experienced a sharp decline, dropping approximately 12% on the day of the announcement. This market response reflects investor concerns regarding the potential loss of revenue and market share for Affirm, as Walmart represents a substantial commerce platform. Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +23.89% per year. These returns cover a period from January 1, 1988 through March 3, 2025. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.