Earlier this year, Bitcoin achieved a new all-time high by trading for little more than $67,000 USD per coin. As this milestone was reached, so grew public interest in Bitcoin. What actually is Bitcoin? How does it operate, and how can you get your hands on it?

In this post, we’ll go through the principles of Bitcoin, highlighting its benefits and drawbacks, how to safely store Bitcoin, and how to buy Bitcoin quickly.

What actually is Bitcoin?

Bitcoin, by definition, is a decentralized digital asset known as a cryptocurrency that is produced and stored online — allowing peer-to-peer transactions to take place without the need for traditional intermediaries such as banks or governments.

Bitcoin is completely decentralized, with no single authority managing its platform. It is controlled by its users, investors, and developers all throughout the world, just as no one controls the technology that powers the internet or email.

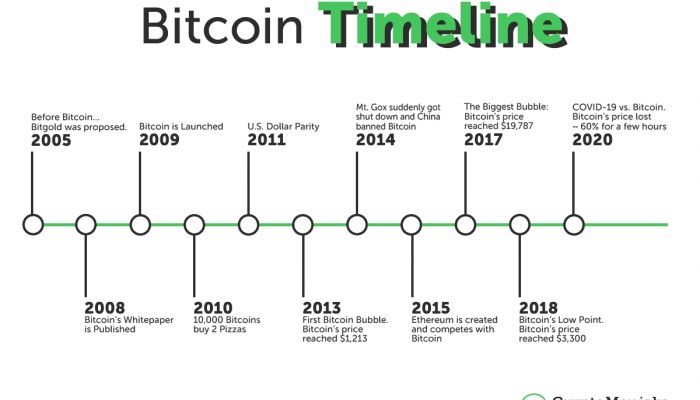

Bitcoin’s History

Satoshi Nakamoto introduced Bitcoin in 2009 as a way to create a currency system that would not rely on existing banks or financial institutions – instead, it would run autonomously using a decentralized record system known as a blockchain.

Bitcoin’s value rose from humble beginnings, hitting $1,000 USD in January of 2017 before peaking later that year. As the first cryptocurrency, its value has undergone highs and lows over the years, showing high volatility.

However, this did not deter investors, as its fan base swiftly expanded to include individuals and institutions who trust in its development potential.

-

Bitcoin’s History – Important Dates

What is the function of Bitcoin?

As stated previously, Bitcoin is a peer-to-peer payment system that operates independently of a central regulating entity that would usually oversee currency production.

Bitcoin’s flow is directly controlled by its users; from one wallet address to another. The total supply is also hard-capped at 21 million coins, making it a fixed asset with the potential to grow in value over time.

To understand how Bitcoin works, you must first grasp the many circumstances in which its system operates:

Blockchain

As previously stated, Bitcoin is digital money that functions on a blockchain, which is a decentralized ledger system. This blockchain functions as a shared public ledger, with each transaction referred to as a block and chained to open-source coding, generating a record of each transaction. This blockchain technology is what allowed other cryptocurrencies to arise.

Private keys and public keys

Bitcoins are kept in a cryptocurrency wallet, which also holds your private and public keys. Consider these keys to be the addresses to which you will send and receive bitcoins and other cryptocurrencies. Remember that your private and public keys are what give you access to your assets. It is impossible to stress the necessity of keeping these keys secure. Never give out your secret keys.

Miners of Bitcoin

Bitcoin miners are platform members that independently verify and confirm blocks, or transactions, using high-performance computers — a process that requires solving an algorithm that verifies that transactions on the blockchain are real. Miners are then rewarded with Bitcoins for their work.

Cryptocurrency Wallets: How to Store Your Bitcoins

Cryptocurrencies, like fiat money, benefit from secure storage in the same way that fiat currencies do.

Bitcoin and other cryptocurrencies are kept in a cryptocurrency wallet. There are various sorts of crypto wallets, with some having more functionality than others. When deciding which wallet is right for you, it’s critical to grasp the two basic types of crypto wallets: software wallets (hot wallets) and hardware wallets (cold wallets),

Software Wallets

Software crypto wallets, as the name implies, are applications or software that operate on your computer, tablet, or phone that is linked to the internet – hence the phrase hot wallets.

The primary benefits of software wallets are their portability, accessibility, and on-the-go trading. As a result, they are a popular choice for newcomers.

The biggest disadvantage of hot wallets is their vulnerability to attacks and/or data breaches. Despite this, it is quite possible to strengthen your hot wallets by employing strong passwords, two-factor authentication, and safe browsing practices.

Exodus and Coinomi are two notable software crypto wallets.

Hardware Wallets

Hardware crypto wallets, also known as cold wallets, are physical devices that store your Bitcoin and digital assets and are not linked to the internet.

These wallets keep your information in an offline environment where you can authenticate and verify transactions, therefore minimizing the risk of potential breaches or bad software compromising your assets or credentials.

Hardware wallets are often regarded as the most secure means of storing bitcoins and other digital crypto assets. They do, however, necessitate a bit more knowledge and ability to effectively set up.

Outstanding hardware Trezor and Ledger are two crypto wallets that incorporate cutting-edge security features.

Bitcoin’s Advantages and Disadvantages

Those interested in investing should be aware of the following benefits and drawbacks:

Pros

- Transparency-One of the most important aspects of Bitcoin is its intrinsic transparency. Almost all information pertaining to its supply and transaction record is publicly available on the blockchain for anyone to verify in real-time.

- Security-Owners have complete control over their transactions due to the decentralized nature of the system. Payments utilizing Bitcoin can be made without the need for personal credentials to be associated with the transaction.

- Freedom of peer-to-peer transactions – Bitcoin is not bound by country boundaries, bank holidays, or government bureaucracy. Anyone in the world, as long as they have internet access, can send and receive Bitcoins at any time.

Cons

- Volatility — There is no disputing that Bitcoin has intrinsic volatility, which is driven by a variety of reasons including, but not limited to, the circulation and number of institutions employing bitcoins, which are currently relatively tiny compared to what they could be. As a result, company operations, big trading volumes, and other minor occurrences might have a substantial impact on its price. This volatility, however, is likely to reduce as Bitcoin’s technology matures and its application is expanded by individuals and businesses worldwide.

- Acceptance — While public interest in Bitcoin is growing, adoption is still a work in progress. Many people are still clueless, therefore gaining the trust and acceptance of businesses will take time. This is gradually changing, as significant institutions such as Paypal have indicated their desire to integrate Bitcoin and cryptocurrency spending into their US market in 2021.

How Do I Purchase Bitcoin?

Bitcoin can be purchased and sold securely on cryptocurrency exchanges. Specialized Bitcoin ATMs are another alternative for purchasing bitcoins with a debit card or cash.

We make it simple for consumers to purchase and sell Bitcoin and other cryptocurrencies at Easy Crypto, with buy and sell orders often processed the same day.

In addition, we offer a crypto exchange option with low prices for quick swapping of your digital assets. For individuals who desire to invest in a specific cryptocurrency on a regular basis, an auto-buy tool is also accessible.

Considerations When Purchasing Bitcoin

The notion of investing in Bitcoin may be intimidating to some. While Bitcoin and cryptocurrencies, in general, can be risky assets to invest in, it is still a popular option for diversifying your financial portfolio.

The following are some frequently asked questions for those interested in purchasing Bitcoin:

Is it wise to invest in Bitcoin?

Bitcoin’s high liquidity, transparency, and future prospects make it an excellent investment asset if you can tolerate its inherent volatility. And, as previously said, Bitcoin’s supply is hard-capped at 21 million coins, implying that its value is expected to rise as it approaches the whole limit.

What is the best method for purchasing Bitcoin?

The most secure way to purchase Bitcoin is through certified cryptocurrency exchanges. Coin exchanges often offer higher rates, lower costs, and, in our case, a crypto switch option that allows you to rapidly adjust your portfolio.

Know more about : Social Media SEO, Disavow Links, DealDash, Binance Coin